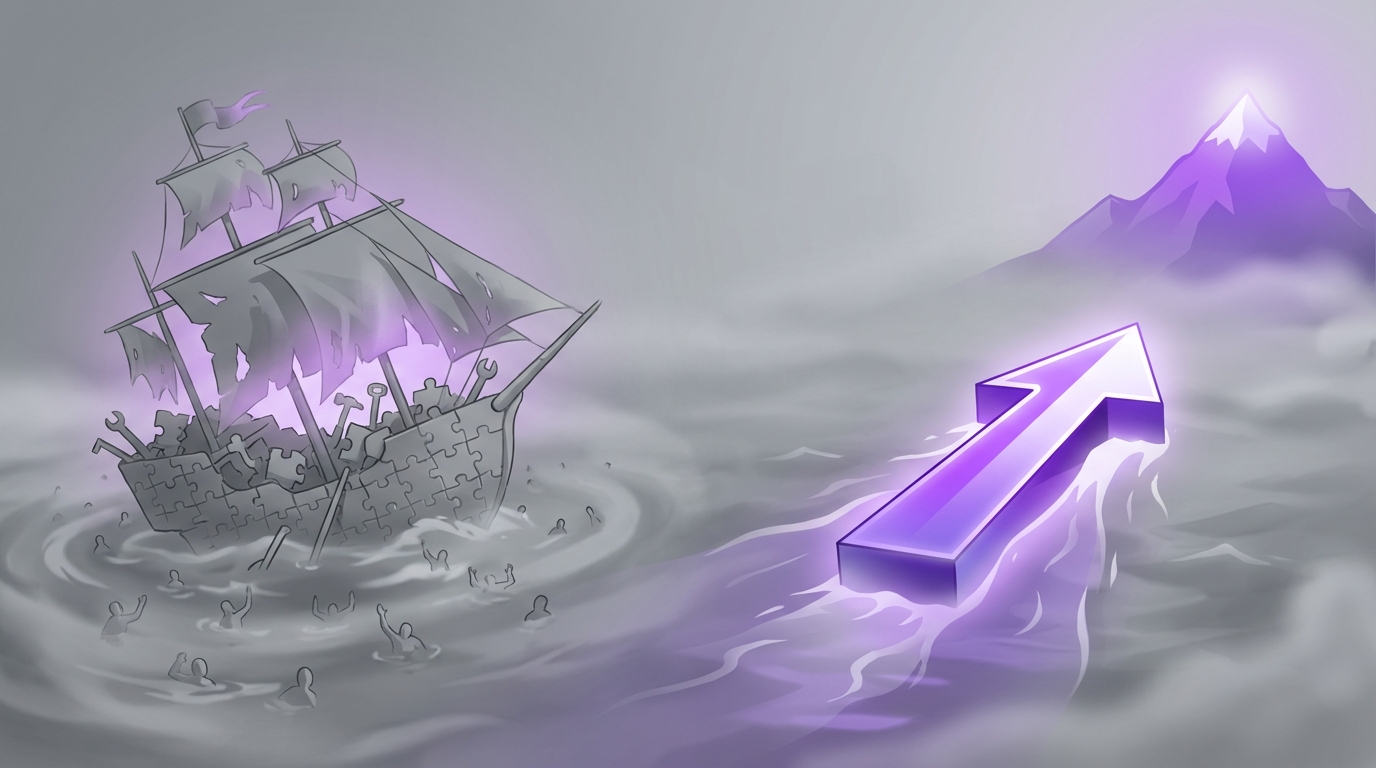

“Generalist agencies are not losing to better creatives. They are losing to clearer positioning and sharper economics.”

The market is voting with retainers and renewals: tightly positioned specialist agencies are growing 2 to 3 times faster in revenue and profit than broad “full service” shops. The generalist pitch sounds safe, but the numbers point in a different direction. Clients pay more, churn less, and refer faster when they believe an agency has “seen their exact movie before.” The P&L reflects that belief. The agencies that resist this shift are not just growing slower. Many of them are quietly becoming unprofitable as acquisition costs rise and margins compress.

For investors, the pattern is plain. Repeatable process plus narrow segment plus strong retention equals a sellable asset. A “we do everything for everyone” agency looks like a people-dependent consultancy with weak pricing power. Buyers discount those businesses because their revenue is fragile and key-person risk is high. Founders feel that in their day-to-day: every proposal is custom, every client thinks their situation is unique, and every quarter feels like a reset. The story is not that generalist agencies forgot how to market. The story is that the economics of attention moved against them.

The trend is not perfectly clean, but the signals stack up. Paid media costs keep rising. Referral loops take longer to spin up. Procurement teams are more sophisticated and more skeptical about broad claims. The agencies that thrive are not always bigger, but they tend to be narrower: “B2B SaaS SEO for PLG products,” “TikTok direct response for beauty brands,” “RevOps for Series B SaaS,” “Email growth for consumer subscription apps.” Each of those niches sounds small until you map the total addressable market and the average contract value. Suddenly the question flips from “Is this too narrow?” to “Can we afford not to choose?”

Business value sits in that decision. A niche agency closes deals faster because prospects recognize themselves in the messaging. Delivery teams build playbooks around repeating the same problems and solutions. That repetition drives down cost per result. Margins expand, even when pricing stays flat. At scale, that predictability is what buyers pay for. A generalist can win big logos and big campaigns, but the effort and randomness push the ROI of founder time in the wrong direction.

“If your homepage could describe 500 other agencies, your pricing power is already gone.”

Why generalist agencies felt safe for so long

For a decade, “full service” felt like the obvious move. Clients wanted fewer vendors. Marketing leaders were under pressure to consolidate budgets. Agency owners heard the same feedback on sales calls: “Can you also handle our email?” or “Do you also do creative?” Saying yes felt rational. Revenue went up. Credibility went up. Case studies piled up across channels and industries. The risk was invisible because market conditions covered it.

Search costs for buyers were higher. There were fewer specialist agencies in each segment. LinkedIn was not flooded with solo operators who only run Facebook ads for coaches or customer acquisition for dental practices. A CMO who wanted “SEO for DTC brands” had to pick from a small pool. So generalist shops with good reputations kept winning those deals. The category grew, but the structure was still forgiving.

Then three forces started to converge:

1. Talent left large agencies and in-house roles to start narrow boutiques.

2. Platforms simplified the tools. Running campaigns or building funnels no longer needed massive teams.

3. Clients gained access to more data and reference points, so pattern recognition improved.

The same CMO can now Google “SEO agency for Shopify brands” and see page after page of focused providers. Each one speaks directly to their tech stack, their merch calendar, their margin pressures. In that comparison set, the generalist “full service digital agency” starts to look vague. Not bad, just vague. Vague is expensive for the buyer because it creates execution risk.

Investors see the same pattern when they look at portfolios. The agencies that niche down early hit lower churn, higher NDR, and better staff utilization. The ones that kept broad positioning find themselves in a weird middle: too big to pivot quickly, not defined enough to stand out. Growth stalls, even if the work quality is solid.

How generalist positioning erodes margins

On the surface, a generalist can quote higher top-line revenue. More services, more industries, wider prospect pool. The issue lives inside the unit economics.

1. Higher cost of acquisition

A generalist agency has to speak to many segments at once. That means broad content, broad outbound, broad networking. Every channel carries a tax: low relevance.

Ads convert worse because the messaging is generic. Sales cycles stretch out because discovery is heavy. Every new prospect requires fresh education. There is no shared shorthand, no “we already know your funnel because we work with five companies just like you.”

A specialist agency, in contrast, can write a case study that basically functions as a sales deck for a very specific buyer. It answers questions before the first call. That compression in the sales process drops acquisition cost per client.

“Niche agencies win not because they shout louder, but because their clients recognize themselves in the story.”

2. Customization tax on delivery

Generalists handle many offer types across many industries. Internal teams live in context-switch mode. Each new account uses different tools, different metrics, different nuances. That reduces reuse of processes and artifacts.

Think about a paid media team that runs:

– eCommerce for apparel

– Lead gen for local services

– B2B SaaS account-based campaigns

– Mobile app installs

Every account needs different creative formats, measurement logic, attribution decisions, even budgeting rhythms. You can build internal standards, but the overlap is thin. Senior staff must step in often. That raises delivery cost.

A niche media shop that only runs user acquisition for mobile subscription apps can standardize:

– Event tracking

– LTV modeling

– Creative testing structures

– Reporting templates

– Weekly meeting agendas

The repetition compounds. New hires ramp faster. QA becomes simpler. The same hour of work yields more predictable output. When that happens across dozens of clients, the EBIT margin widens.

3. Pricing power and the “premium specialist” effect

Pricing is where the business value gap shows clearly.

Here is a simple comparison table for typical retainers and margin profiles.

| Agency Type | Average Monthly Retainer | Gross Margin Range | Client Tenure (Median) |

|---|---|---|---|

| Generalist full-service | $8,000 – $25,000 | 35% – 45% | 9 – 14 months |

| Channel specialist (e.g. SEO only) | $5,000 – $30,000 | 45% – 60% | 14 – 24 months |

| Niche + channel (e.g. SEO for B2B SaaS) | $10,000 – $40,000 | 55% – 70% | 18 – 30 months |

A generalist might charge a similar retainer to a specialist. The gap is in the cost to deliver each dollar of revenue and the length of time each dollar stays.

Clients pay a premium for experts that speak to their specific context:

– Industry norms

– Buying cycles

– Typical channel mix

– Benchmarks that matter

That context awareness reduces perceived risk. Buyers pay for that reduction. Generalists can try to match the rate card, but every extra revision, audit, and meeting chips away at the underlying margin.

Why “we do everything” weakens your brand story

When an agency pitches broad capability, it thinks it is selling convenience. A single partner for all growth needs. Fewer vendors. Fewer contracts. That story made sense when options were scarce. In a market crowded with specialists, that same story sounds like lack of conviction.

From a brand perspective, a generalist struggles with three core questions:

1. Why us?

2. Why now?

3. Why at this price?

The answers often drift toward subjective arguments: “We care more,” “Our team is senior,” “We have a unique process.” Those lines are hard to prove and easy for competitors to copy on their own sites.

A niche agency can answer those questions in commercial terms:

– “We help Series A-C B2B SaaS companies grow organic ARR by focusing on bottom-of-funnel SEO content and conversion.”

– “We help health and wellness DTC brands grow paid social from $50k/month to $500k/month while protecting MER.”

– “We help multi-location dental practices grow new patient volume with local search and review management.”

Each of those answers is narrow, but the business value is clear. The narrower statement does not push away good-fit clients. It pulls them in. It also gives a reason to charge more. The prospect is not buying marketing in general. They are buying a specific revenue outcome you have produced many times in their exact setting.

Investor lens: why buyers prefer niche agencies

From an investor’s point of view, agencies are tough assets. They are people-heavy, margin-sensitive, and exposed to client concentration risk. The ones that still earn strong multiples share common traits:

– Repeatable process

– Clear ICP (ideal client profile)

– Diversified client base within that ICP

– Documented delivery and sales

– Strong retention

Niche agencies fit that pattern more naturally. The ICP is clear by definition. The process tends to be tighter because the problems are similar. The client base diversifies within a segment instead of spreading across segments. That concentration helps with referrals and brand equity.

Generalist shops can still be acquired, but the buyer often treats them as capability roll-ups:

– “We want your paid media team and book of business.”

– “We want your dev practice.”

– “We want your healthcare vertical.”

The multiple goes to the piece that is already niche inside the generalist structure. Everything else becomes noise in the model.

Here is a simplified view of how positioning maps to investor perception.

| Positioning | Perceived Risk | Process Repeatability | Typical Exit Multiple (Revenue) |

|---|---|---|---|

| Broad generalist | High | Low – Medium | 0.5x – 1.0x |

| Channel specialist | Medium | Medium – High | 1.0x – 1.8x |

| Niche + channel specialist | Medium – Low | High | 1.5x – 3.0x |

These ranges shift by region and scale, but the pattern holds. A niche gives investors rational reasons to believe next year will look like this year, only larger. A generalist relies more on founder presence, hustle, and reputation. That story prices lower, even if the gross revenue is higher.

How “niching down” reshapes your revenue model

Niche is not only a marketing story. It is an operating model that affects:

– How you price

– How you deliver

– How you staff

– How you forecast

From hours and tasks to outcomes and models

Most generalist agencies start with time-based or scope-based pricing:

– X hours per month

– Y deliverables per quarter

– Blended rates

Those models are fragile because every project is different. Estimation is guesswork. Overruns eat margin. The client relationship revolves around tasks, not outcomes.

A niche agency, by repeating the same problem, can shift toward:

– Outcome-based retainers

– Productized projects

– Hybrid performance structures

For example:

– “Launch and scale paid social from zero to first $100k/month spend for DTC apparel brands at a fixed fee plus revenue share.”

– “Migration and relaunch SEO for B2B SaaS at Series B with a flat project fee and 6-month retention retainer.”

– “Cold outbound engine build for US-based B2B agencies targeting $1m+ ARR clients.”

Each offer can be scoped tightly because the agency has done it many times. That precision reduces risk on both sides. The client feels clarity. The agency can protect margin.

Staffing leverage and training loops

In a generalist shop, training a new strategist takes a long time. They must learn many sectors, offers, channels, and tools. Senior staff carries a larger load. That cap on leverage slows growth.

In a niche shop, training focuses on:

– One ICP

– A limited set of offers

– A known group of platforms

Playbooks and templates carry more of the load. Senior people design improvements instead of firefighting across random projects. That leverage is where EBITDA grows.

For example, a small team can deliver:

– 10 B2B SaaS content SEO accounts, each with similar content types, workflows, and approvals.

– 15 local service accounts with near-identical Google Ads structures and landing pages.

– 20 Shopify brands with a shared Klaviyo email strategy framework.

The agency still needs smart people, but the ratio of revenue per head improves. That ratio drives investor interest and founder freedom.

The hidden risk of “keeping your options open”

Many founders resist niche because they fear turning away revenue. The logic sounds sensible: “We cannot say no to money” or “We can always niche later.” The cost of that delay is rarely in the deals they lose. It is in the deals they never see.

A fuzzy brand attracts fuzzy leads. That weak top-of-funnel flow forces founders to rely on personal networks, outbound, or RFPs. Those channels can work, but they are random and time-intensive. A niche brand, by contrast, creates compounding inbound:

– People search for very specific help.

– They find your site because it speaks directly to that need.

– They refer peers who share the same context.

The opportunity cost is also internal. Without a niche, the team cannot build depth. They keep re-learning the same lessons in different contexts. Every win stays local to that account. Niche agencies can apply a win from one client to five others within weeks.

“When your agency says yes to every category, you are not diversifying risk. You are diluting proof.”

Where generalist agencies still win (and why that edge is shrinking)

The story is not that generalist agencies are doomed across all segments. There are pockets where breadth still carries weight:

– Large enterprises that want one vendor to coordinate many channels.

– Brands that see their agency as an extension of internal marketing.

– Complex campaigns that cross offline and online.

These accounts often come with large retainers and long sales cycles. They also come with procurement, long payment terms, and heavy reporting demands. A generalist with strong project management can thrive here for a while.

The edge is shrinking for two reasons:

1. Enterprises now build in-house centers of excellence and bring in specialists to fill gaps.

2. Specialist agencies join forces informally to pitch together, giving the client breadth without a single-vendor contract.

The generalist promise of “one throat to choke” starts to feel less attractive when a specialist coalition can prove better performance in each lane, while an internal leader coordinates.

Signals your generalist agency is starting to sink

Owners often feel the pain before they can name the cause. The metrics show up first.

Common signals:

– Proposal win rate sliding, even though referrals are still strong.

– Prospects pushing harder on price and asking for “more included.”

– Team burnout rising because of context switching and rework.

– Revenue growing top-line but profit staying flat or dropping.

– Retainers shrinking in scope as clients peel off pieces to specialists.

Those signals are not always fatal. They do point to a positioning problem. If your best clients are hiring specialists around you, they are telling you where they perceive your value stops.

The economics of niching down: a simple model

Consider two agencies over a 3-year period.

Agency A: Generalist

Agency B: Niche

Assume both start at $1m in annual revenue.

| Metric (Year 3) | Agency A (Generalist) | Agency B (Niche) |

|---|---|---|

| Annual revenue | $2.0m | $2.0m |

| Number of clients | 40 | 25 |

| Average monthly retainer | $4,200 | $6,700 |

| Gross margin | 42% | 60% |

| EBITDA margin | 8% | 22% |

| Average client tenure | 11 months | 21 months |

Same revenue top-line. Very different owner experience.

Agency A:

– More accounts to manage.

– Higher dependence on new sales.

– Less cash cushion.

Agency B:

– Fewer relationships to nurture.

– More predictability from longer tenures.

– Higher profit to invest in team, content, or acquisitions.

From a buyer’s view, Agency B is a safer bet even before growth assumptions. The niche itself becomes part of the valuation.

How specialization compounds learning and moat

An agency working only with a segment sees patterns earlier:

– Which channels are saturating.

– Which offers are converting.

– Which message frameworks are fading.

That early signal becomes a moat. You update playbooks before competitors. You guide clients away from wasted tests. Your case studies stay current. Generalists struggle to see those patterns because their data is spread thin across unrelated markets.

Over time, niche agencies can build:

– Proprietary benchmarks.

– Internal tools tailored to their segment.

– Templates and scripts that only make sense inside that niche.

Those assets deepen the moat. Clients feel the difference in calls: your team speaks their language, references their peers, and surfaces insights from a relevant sample, not generic marketing articles.

Funding and growth paths for niche agencies

Capital allocators are more willing to fund an agency that looks like a product company in its behavior:

– Clear ICP.

– Defined problem.

– Standard solution.

– Repeatable revenue.

Niche agencies, by nature, are closer to that pattern. They can:

– Standardize onboarding and delivery.

– Build tech to automate recurring pieces.

– Package their process into software-enabled services.

That path opens options:

– Minority growth capital to accelerate sales and hiring.

– Strategic acquisitions of micro-agencies inside the same niche.

– Eventual exit to a platform roll-up or a strategic buyer in the same vertical.

Generalist agencies can still raise or exit, but the pitches tend to lean on top-line scale and marquee clients. The buyer discounts for fragility: key-person reliance, wide service mix, vague ICP.

Practical constraints: when niching down is hard

Not every agency can pivot overnight. Real constraints exist:

– Legacy contracts across unrelated industries.

– Teams hired for broad skills rather than depth in a segment.

– Brand name that already signals generalist positioning.

The financial risk is real. Cutting service lines or markets too fast can create revenue gaps that cash reserves cannot cover. Owners must treat the shift as a series of bets, not a single leap.

That said, the risk of holding the generalist line grows each year. More specialists enter the market. Platforms commoditize more of the execution. AI automates more of the generic tasks. The residual value of “we can do a bit of everything” declines.

Where the market is heading next

Three forward trends are already visible:

1. **Verticalized networks of micro-specialists**

Small niche agencies band together informally or via holding companies. Each stays narrow, but the client experiences a full funnel of experts. This structure attacks the old generalist pitch from both sides: depth and breadth.

2. **Productized service layers on top of platforms**

Agencies will build thin product layers on top of major ad and CRM platforms that are tuned to one vertical. The service becomes a wrapper around that product. This structure needs niche focus to make economic sense.

3. **Hybrid agency / media / education models**

Niche agencies start podcasts, newsletters, and communities just for their segment. That content feeds lead flow and increases switching costs. A generalist cannot credibly create that kind of focused media without first choosing a side.

In that context, “niche down or die” is less a dramatic slogan and more a pragmatic forecast. Generalist agencies can survive, but the market is making it harder each quarter to grow profitably without a clear segment and a repeatable engine.

The question is not whether your agency can keep selling broad services. The question is what kind of business you want to own in 3 to 5 years: a fragile, people-heavy shop fighting for generic RFPs, or a focused, high-margin specialist that buyers line up to work with and investors line up to back.